Dreaming of starting your own business with $50k? You’re in the right place! Discover the best ventures to kickstart with this budget. From online stores to service-based businesses, we’ve got you covered. With a modest investment, you can turn your entrepreneurial vision into reality. Stay tuned to explore lucrative opportunities that align with your budget and passion. Ready to take the leap into entrepreneurship? Let’s dive in!

Identifying Profitable Business Ideas

Market Trends

Researching market trends is crucial to identify lucrative business opportunities. By staying updated on industry trends, you can spot gaps in the market and cater to evolving consumer demands effectively. For instance, the rise of e-commerce has opened up opportunities for online businesses like an online bakery.

Competition Analysis

Analyzing competition helps in differentiating your business venture. Understanding what competitors offer allows you to position your business uniquely and attract potential customers. By offering a unique selling proposition, you can stand out in a crowded market and maximize profit margins.

Scalability and Sustainability

Considering scalability and long-term sustainability is vital when selecting a profitable business idea. A case study approach can help in assessing the income potential and growth prospects of a business idea. By focusing on scalability, you can ensure that your business has the potential to grow and generate passive income over time.

Crafting a Comprehensive Business Plan

Setting Clear Objectives

Crafting a business plan involves setting clear objectives that define the project’s direction and goals. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART). By detailing the purpose of the development, entrepreneurs can effectively steer their businesses towards success.

Financial Projections and Marketing Strategies

In a business plan, financial projections play a crucial role in outlining the expected revenue, expenses, and profits over a certain period. Entrepreneurs need to conduct thorough research on the industry to make accurate financial estimates. Marketing strategies should be strategically planned to reach the target audience effectively.

Defining Target Audience and Unique Selling Propositions

Identifying the target audience is essential for tailoring products or services to meet their needs. Entrepreneurs must also define their unique selling propositions (USPs) to differentiate themselves from competitors. Highlighting these USPs in the business plan can attract customers and create a competitive edge in the market.

Contingency Plans and Risk Management Strategies

Including contingency plans in the business plan helps mitigate potential risks that may arise during operations. Entrepreneurs should anticipate challenges such as economic downturns or unexpected events and devise risk management strategies accordingly. By addressing these uncertainties proactively, businesses can adapt swiftly to changing circumstances.

Selecting the Right Business Structure

Pros and Cons

When deciding on a business structure, individuals should weigh the pros and cons carefully. Sole proprietorship offers simplicity but comes with unlimited liability. LLCs provide flexibility and limited liability protection, while partnerships allow shared responsibilities but also shared liabilities. On the other hand, corporations offer strong liability protection but involve more complex regulations.

Consulting with Experts

It is crucial to consult with legal and financial advisors when exploring different business structures. These professionals can provide valuable insights into the tax implications and legal obligations associated with each type. Their expertise can help in making an informed decision that aligns with long-term business goals.

Tax Implications and Liability Protection

Understanding the tax implications of each business structure is essential for franchise options or independent ventures. Sole proprietors report business income on their personal tax returns, while corporations face double taxation but enjoy certain deductions. Moreover, liability protection varies across structures, influencing personal asset protection in case of legal issues.

Paperwork and Licensing

Completing the necessary paperwork for business registration is crucial. This includes obtaining the required licenses and permits. Each business structure has its own set of requirements, so make sure to research thoroughly.

Securing an Employer Identification Number (EIN) from the IRS is essential for tax purposes. This unique number identifies your business entity when dealing with the IRS. It’s like a social security number but for your business.

Compliance with Regulations

Complying with local, state, and federal regulations is non-negotiable. Ignoring these regulations can lead to legal disputes that may jeopardize your business’s future. Stay informed about any changes in laws that may affect your industry.

When it comes to legalities, ensure you have a clear understanding of all the laws that apply to your specific business. For example, if you’re opening a vape shop, there are specific regulations regarding the sale of tobacco products that you must adhere to.

Effective Marketing and Promotion Strategies

Multi-Channel Approach

Develop a multi-channel marketing strategy to reach a diverse target market. Utilize digital marketing to leverage online platforms, social media for engaging with potential customers, and traditional advertising for broader reach.

Enhancing Brand Visibility

Implement SEO techniques to boost online visibility and attract organic traffic. Employ content marketing strategies to provide value to your audience and establish your brand as an authority in the industry. Collaborate with influencers to tap into their followers and expand your brand’s reach.

Customer Engagement and Retention

Utilize customer relationship management tools to effectively manage interactions with customers. This includes lead generation, personalized communication, and post-purchase follow-ups. By engaging with customers consistently, you can build trust, loyalty, and increase repeat sales.

Financial Planning for New Businesses

Startup Costs

When starting a new business, it’s crucial to create a detailed budget to allocate the $50k initial investment wisely. Consider expenses like equipment, inventory, permits, and marketing. Research the median cost of similar ventures to set realistic projections.

Operational Expenses and Revenue Projections

Business owners should establish financial controls to monitor cash flow effectively. Track operational expenses such as rent, utilities, salaries, and other recurring costs. Project revenue growth based on market research and projected growth rates in your industry.

Funding Options for Growth

Explore various funding options beyond the initial $50k investment. Look into small business loans from banks, grants from government agencies or private organizations, or attracting investors interested in your venture’s potential growth rate. Utilize these resources to support expansion plans and ensure long-term sustainability.

Building a Strong Management Team

Recruiting Professionals

Recruit skilled professionals with expertise in areas like finance, marketing, and operations to enhance business performance.

Hire partners who bring diverse skills to the table, such as experience in growth strategies or maintenance services for a well-rounded team.

Establishing Clear Roles

Define clear roles and responsibilities for each partner based on their strengths to ensure efficient workflow and avoid overlap.

Assign specific tasks like overseeing store operations, managing hours of operation, or maintaining machines to optimize productivity.

Training and Development

Offer ongoing training opportunities to keep the management team updated on industry trends and best practices.

Empower partners with the necessary skills and knowledge to make informed decisions that drive business success.

Avoiding Common Startup Pitfalls

Regular Evaluation

Regular performance evaluations are crucial for startups to identify strengths and weaknesses accurately. By conducting these assessments, businesses can pinpoint areas that require improvement and implement necessary changes promptly. This proactive approach helps in optimizing operations and ensuring long-term sustainability.

Seeking Feedback

Feedback from various sources such as customers, employees, and industry experts is invaluable for startups. Customer feedback provides insights into satisfaction levels and areas for enhancement, while employee feedback aids in boosting morale and productivity. Industry expert feedback offers valuable perspectives on market trends and potential growth opportunities.

Adaptability and Change

Remaining adaptable and open to change is essential for startups facing uncertainties in the business landscape. Being flexible allows businesses to pivot quickly in response to market shifts or emerging trends. Embracing change enables startups to capitalize on new opportunities and stay ahead of competitors.

Final Remarks

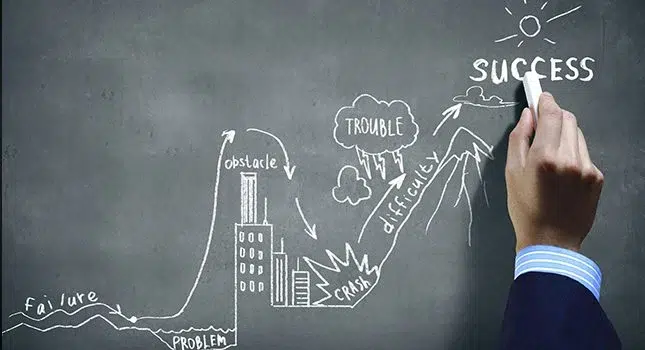

You’ve now equipped yourself with the essential knowledge to kickstart your entrepreneurial journey. By identifying lucrative business ideas, creating a solid business plan, and navigating legal requirements wisely, you’re on the path to success. Remember to focus on effective marketing strategies, financial planning, team building, and avoiding common pitfalls. Your dedication and strategic approach will be key to turning your $50k investment into a thriving business.

Take action today! Start implementing these steps and watch your business flourish. Your determination combined with the right strategies will set you apart in the competitive business landscape. Stay focused, stay motivated, and soon you’ll see your entrepreneurial dreams turn into a profitable reality.

Frequently Asked Questions

What are some key factors to consider when identifying profitable business ideas?

When identifying profitable business ideas, consider market demand, competition analysis, your skills and interests, scalability potential, and financial requirements.

How important is crafting a comprehensive business plan for a new business?

Crafting a comprehensive business plan is crucial as it outlines your goals, strategies, financial projections, and helps secure funding. It serves as a roadmap for your business’s success.

What are the different types of business structures to consider when starting a new venture?

Common business structures include sole proprietorship, partnership, limited liability company (LLC), and corporation. Each structure has unique legal and tax implications that should align with your business goals.

Why is effective marketing essential for a new business?

Effective marketing helps create brand awareness, attract customers, and drive sales. Utilize digital marketing strategies such as social media marketing, content marketing, SEO, and email campaigns to reach your target audience efficiently.

How can financial planning benefit new businesses?

Financial planning helps new businesses manage cash flow effectively, make informed decisions, allocate resources wisely, and achieve long-term growth. It provides insights into expenses, revenue projections, and ensures financial stability.